After 68 years, Tatas win back Air India

It will take ‘considerable effort’ to rebuild the debt-laden airline, says Ratan Tata.

After 68 years, Air India is all set to return to the Tata fold. Tata Sons subsidiary Talace Pvt Ltd emerged as the winning bidder for the debt-laden national carrier after quoting an enterprise value of ₹18,000 crore. The government will take a hit of ₹28,844 crore.

The Tatas will own 100% stake in Air India, as also 100% in its international low-cost arm Air India Express and 50% in the ground handling joint venture, Air India SATS. Apart from 141 planes and access to a network of 173 destinations including 55 international ones, Tatas will also have the ownership of iconic brands like Air India, Indian Airlines and the Maharajah.

The Group of Ministers led by Home Minister Amit Shah approved the winning bidder in its meeting on October 4, 2021. The government aims to complete the transaction by December, 2021, when it will transfer its shares and handover the airline to the new buyer.

“Talace has quoted an enterprise value of ₹18,000 crore. Of this, ₹15,300 crore is the debt component of Air India to be taken on by the winner, and the remaining ₹2,700 crore will be cash paid to the government,” DIPAM Secretary, Tuhin Kanta Pandey, said at a press briefing. The government had revised the bidding criteria last year and invited bids on enterprise value (equity and debt value), which allowed players the flexibility to quote the debt they were willing to take on instead of a pre-determined, fixed debt along with minimum cash consideration of 15% for equity.

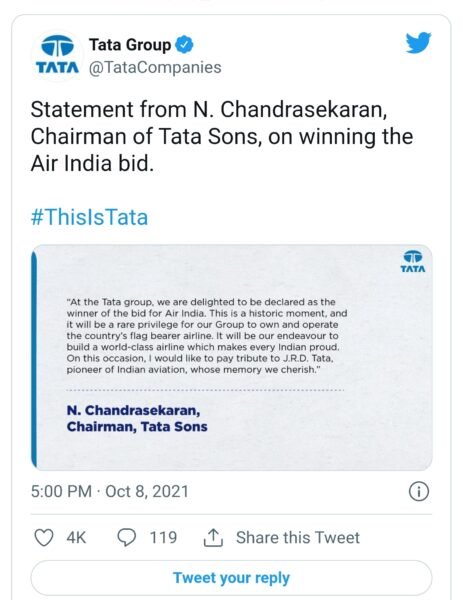

“On an emotional note, Air India under the leadership of Mr JRD Tata had, at one time, gained the reputation of being one of the most prestigious airlines in the world. Tata will have the opportunity of regaining the image and reputation it enjoyed in earlier years. Mr JRD Tata would have been overjoyed if he was in our midst today,” Ratan Tata, Tata Group’s Chairman Emeritus said in a statement. He added that it will take “considerable effort” to rebuild Air India, though at the same time “it will provide a very strong market opportunity to the Tata Group’s presence in the aviation industry”. Tata Sons owns 84% share in Air Asia which has a market share of 5.2%, and 51% stake in Vistara which has a market share of 8.3%. Together with Air India’s market share of 13.2%, Tatas could be in control of 26.7% market share and be the second biggest player after IndiGo.

The second bidder, a consortium led by Ajay Singh, had quoted an equity value of ₹15,100 crore. The reserve price fixed by the government before opening the bids on September 28 was at ₹12,906 crore.

The government will absorb the balance debt of ₹46,262 crore, which will be transferred to a special purpose vehicle (SPV) set up by it- Air India Assets Holding Limited. When adjusted against non-core assets such as land and buildings worth ₹14,718 crore that will also be parked in the SPV and the cash amount of ₹2,700 crore from Tatas, the net liability on the government comes to ₹28,844 crore.

“The tax payers have put in ₹1,10,277 crore in Air India since 2009-2010, which includes ₹54,584 cash support and ₹55, 692 as guarantee support for loans. There are no underlying assets as such. This is all loss being funded through the debt guaranteed by the government. AI has a loss of ₹20 crore a day.” Mr Pandey explained the government decision to sell the airline for ₹18,000 crore.

Employees

“The government has addressed all the concerns of the employees. The winning bidder will retain all employees for a period of one year. In the second year, if anyone has to be removed, they will be offered Voluntary Retirement Scheme . They will be provided gratuity and provident fund benefits as per the applicable law of the land. The post-retirement medical benefits of those who have retired and those who will be retiring will also be taken care of by the government,” Secretary, Ministry of Civil Aviation Rajiv Bansal said. Air India and Air India Express have 13,484 total permanent employees.

It is a great day for Indian aviation. The sale of Air India is one of the biggest reforms in the aviation sector. It is a win- win for all, though there is a long road ahead for rebuilding Air India which will require very long term and patient capital. Its turnaround will take time,” said Kapil Kaul of CAPA India.

source: https://www.google.com/amp/s/www.thehindu.com/business/Industry/after-68-years-tatas-win-back-air-india-with-18000-crore-bid/article36895747.ece/amp/